Transform Your Lending Business

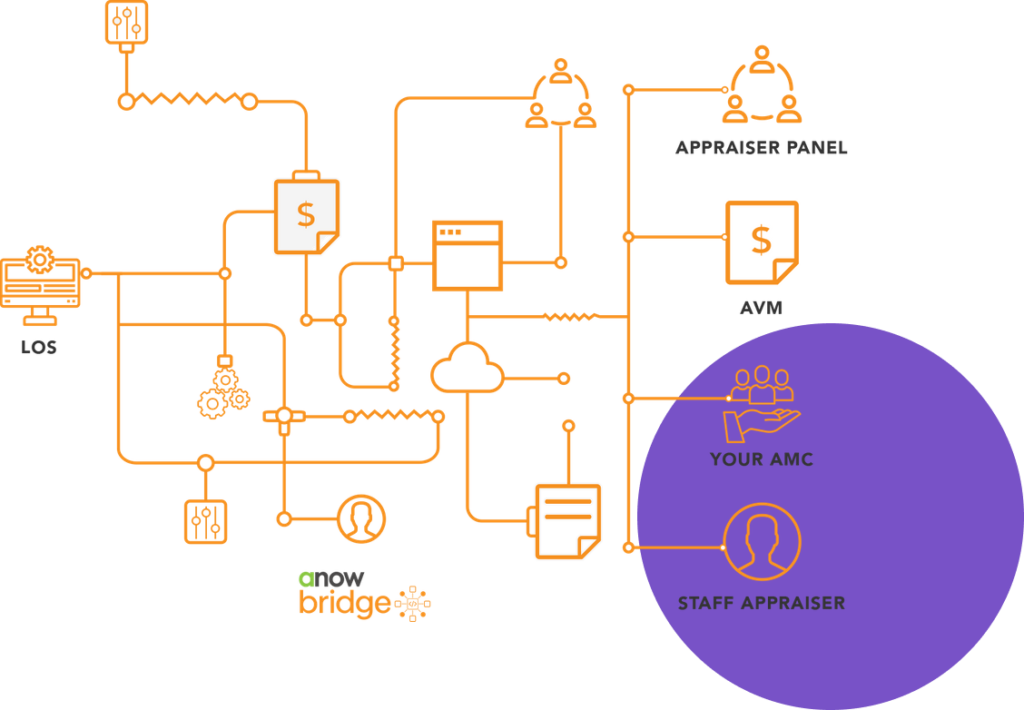

Integrate your LOS, automate order assignment and appraisal review workflows, work with one or more AMCs or your in-house appraisal team, and so much more. Watch your appraisal business flourish with Anow for lenders.

Automate, Customize, Simplify

Automate, Customize, Simplify

One thing is for certain: lenders are busy and every minute is a valuable resource. There’s no time to waste when it comes to finding available assignees, allocating orders, and completing reviews. Regardless of what challenges you face being a lender and working with appraisers, Anow comes with sophisticated solutions to give you peace of mind.

Save time and money with an end-to-end solution designed for modern-day lenders who want to take control of their business, and grow in the appraisal industry.

Discover how Anow can help your business

Discover how Anow can help your business

Anow packs powerful tools that can help you manage orders and provide outstanding customer service into one beautiful dashboard. And that’s just the start.

Data Protection Guarantee

You can rest assured that your data will never be compromised or sold. You own your data!

Simplify Panel Management

All AMCs and appraisers you work with live in Anow, along with your appraisal order details. This makes it easy to delegate work and assign the right team for the job.

Dedicated Lender Support

Enjoy a dedicated Account Manager with technical and process support to give your lending business all the resources you need for success.

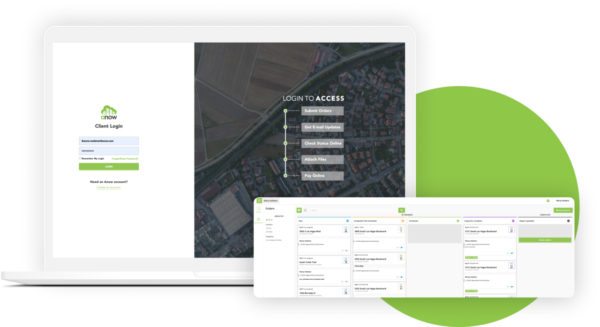

Appealing, Modern Design

Visualize every order status and detail with an easy-to-read kanban board, or choose the order list view. Group appraisals by location or company to find what you’re looking for, fast.

White Label Everything

Entirely customized to your brand identity, Anow makes you stand out. White label everything from the order management system, login pages, to the Nexus report writer. Make your brand known!

It's All Automatic

The goal is to simplify your life, so we’ve taken the liberty of automating all of the important milestone tasks: Order assignment to appraisers and AMCs, Risk Reports are accompanied with every order, billing notifications, appraisal review checklists, and more.

Artificial Intelligence Backed Compliant Reports

Artificial Intelligence Backed Compliant Reports

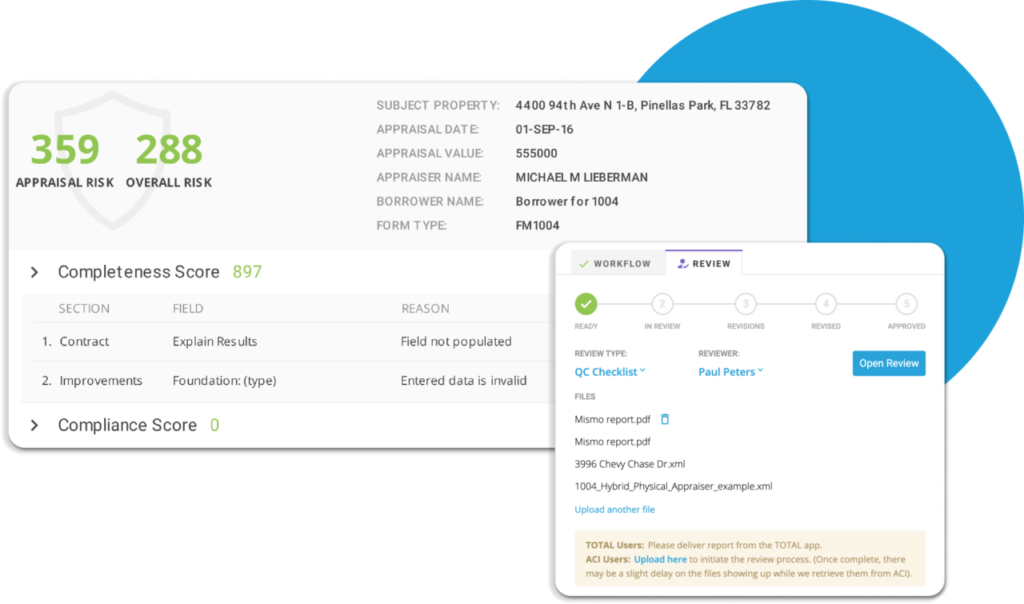

Anow’s automated review features and Compliant Executive Summary Reports (Nexus Risk) are backed with augmented artificial intelligence to ensure your team can efficiently complete their duties based on specific rules and requirements.

Your appraisers will be aware of any risks and compliance issues prior to submitting the final report to your client with each Nexus Risk Report.

Everything From Your LOS Syncs Directly Into Anow

Everything From Your LOS Syncs Directly Into Anow

No matter what Loan Origination System you use, it can be integrated with your Anow account thanks to our advanced API and custom integration capabilities.

Order details and statuses are consolidated in one place for reliable, easy access to all of the information you need.